Estimated reading time (in minutes)

The transfer of shares requires a certain number of guarantees, both for the purchaser and for the transferor. The lawyer’s deed allows both parties to protect themselves against any disputes that may arise after the assignment.

The importance of the spouse:

The transferor often forgets the impact of his matrimonial regime and the need to involve his spouse in the deed of transfer. Indeed, even if the spouse is not a partner, he must consent to the deed of transfer and sign it, provided that he is married to the transferor under the regime of legal community and the transferor has no not use own assets for the acquisition of shares. Failing this, the spouse may request the cancellation of the deed of transfer, even if the purchaser is in good faith.

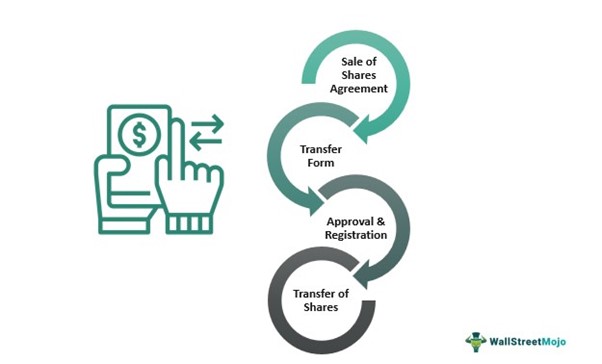

The approval procedure:

The transfer is valid only if it has been authorized according to the legal procedure of approval and in accordance with the statutory provisions. The transfer project must then be notified by registered letter to each of the partners, who have a period of three months to decide. The lawyer’s deed must mention compliance with the approval procedure and the fact that all the partners have approved the transfer.

Guarantee commitments:

The lawyer must alert the assignor to the need to obtain the agreement of the creditors for the discharge of their suretyship commitment. It is therefore necessary to provide for a substitution clause in the deed of transfer. The buyer will then take responsibility for the transferor’s surety commitments. In the absence of a substitution clause, the transferor remains committed as surety on everything he has transferred and can be sued.

The distribution of dividends:

The deed of transfer must provide for the terms of distribution of the dividends to avoid any conflict. In principle, unless otherwise agreed between the parties, the buyer is entitled to dividends not yet distributed on the day of the sale. If the dividends are granted to the purchaser, an increase in the sale price must be considered for the part of the dividends that the seller should have received for the period preceding the sale. This is all the more important when the transfer takes place in several stages. In this case, the dividends paid to the transferee may be deducted from the balance of the transfer price to be paid.

Hidden liabilities:

Acquirers are not always aware that by taking control of a company, they also inherit its liabilities. The legal guarantee against latent defects does not cover the value of the securities transferred, but only their existence. It is therefore necessary to provide for a contractual clause. It can be a net asset guarantee clause, a price review clause, or a liability guarantee clause. The latter is recommended because it aims to guarantee the buyer against any undisclosed liabilities at the date of the transfer and whose origin is prior to the sale. In addition, it obliges the seller to guarantee the buyer against the reduction in value of the shares due to the undervaluation of the liabilities. Another advantage: it has no ceiling, unlike the price review clause.

Payment guarantees:

The transferor must be guaranteed with the act of lawyer against the insolvency of the purchaser, especially if the transfer is done in several stages with a staggered payment. There are several types of warranty. It is possible to include a resolutory clause which allows the transfer to be canceled in the event of incomplete payment. The lawyer can also provide for the pledge of the shares, which allows the recovery of the shares in the event of incomplete payment. It is also possible to include a bank guarantee commitment where the bank will replace the buyer in the event of default.

DAMY Law Firm , Nice, Update 2022