Estimated reading time (in minutes)

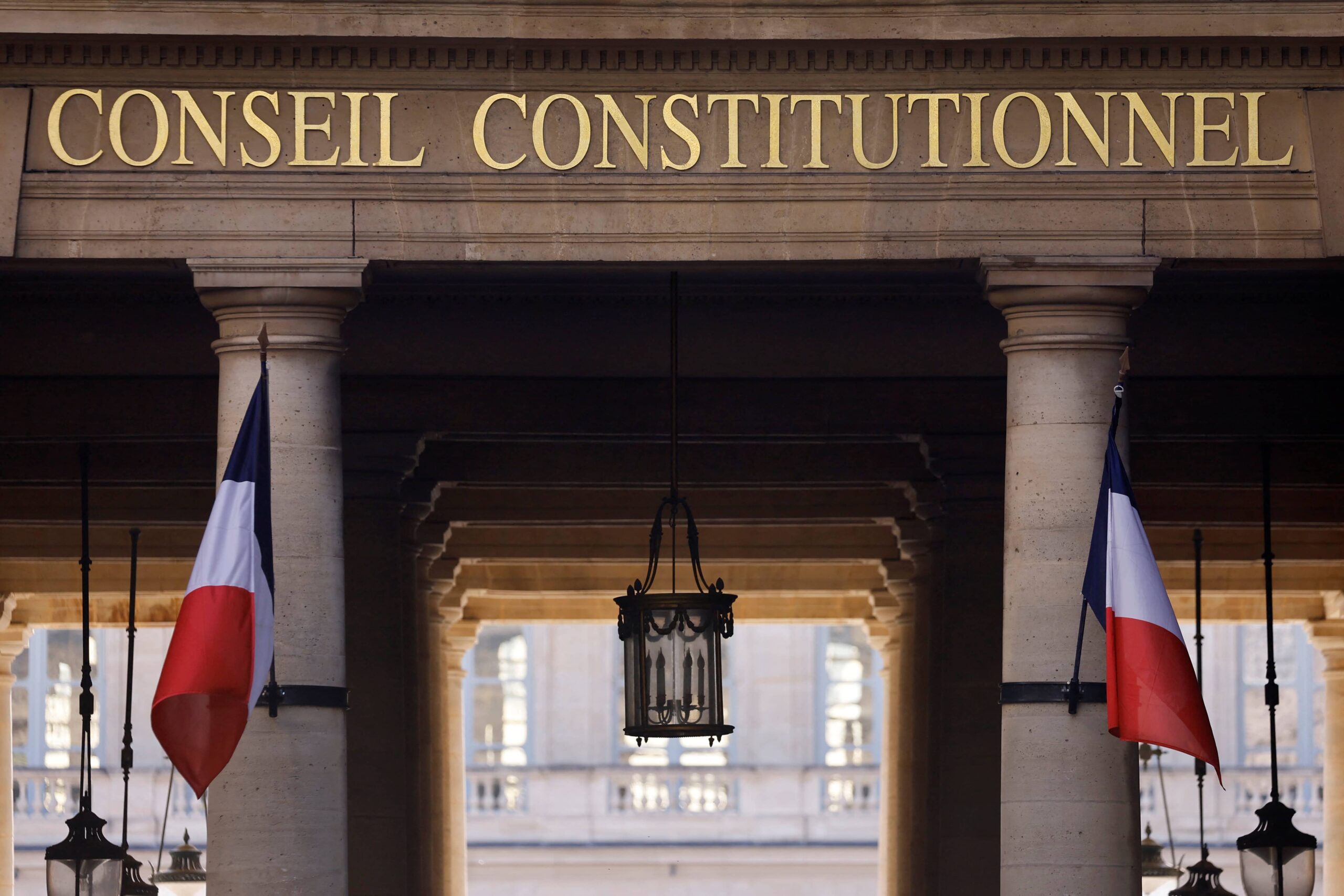

Role of the Constitutional Council the decision taken by the Council on December 29, 2012 raises the question of whether the Elders have sinned by excess of wisdom. While it is important to recognize that the Declaration of Human Rights, in Article 13 , emphasizes consideration of the contributory capacity of the taxpayer, no specific limit or threshold is provided.

The role of the Constitutional Council in determining tax ceilings: –

However, the Constitutional Council has set a limit beyond which a tax becomes confiscatory, assuming the character of a punitive measure that may be deemed justifiable. Taxes, while not just a deterrent, should only aim to influence behavior change. In this case, the Constitutional Council affirms that a certain level of taxation becomes unbearable and questions the discretionary power of Parliament to assess what is politically legitimate.

This decision of the Council implicitly establishes a ceiling for compulsory deductions, limiting them to 70% of an individual’s income. In addition, the Council also abolished certain new taxes, such as the tax on stock options or pensions, deemed excessive or even “confiscatory”.

Balancing power: Parliament versus Constitutional Council: –

The implications of this decision are significant as it sets a precedent for assessing the appropriateness of tax levels and highlights the role of the Constitutional Council in protecting individuals against excessively heavy taxation. By setting ceilings on compulsory levies, the Council affirms its authority to ensure fairness and prevent excessive encroachments on the financial resources of individuals.

The move also raises wider questions about the balance of power between the Council and Parliament. This calls into question who holds the ultimate authority to determine what constitutes politically legitimate taxation. The Council’s involvement in setting tax limits serves to serve as a reminder of the delicate balance between the legislative and judicial powers of government and their respective roles in shaping fiscal policy.

In conclusion, the Council’s decision on tax levels and the removal of certain taxes reflects its responsibility to prevent confiscatory measures and to respect the principles of fairness and proportionality. Although this decision may invite further debate on the distribution of powers between the Council and the Parliament, it reaffirms the Council’s vital role in safeguarding citizens’ rights and guaranteeing the legitimacy of budgetary policies .